Silver Prices Reacting To The Market: Will Prices Stabalize

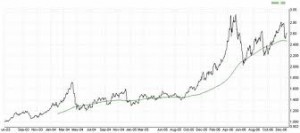

By Kyle Young on May 21, 2011, 9:58 am Last month, silver prices skyrocketed to an all-time high of $48 an ounce, causing many Americans to rifle through their jewelry boxes, attics and drawers for old necklaces and other silver trinkets. Silver is now trading at about $35 an ounce, but with gas and food prices soaring, people still are looking to raise some money by unloading their shiny objects. Ordinarily playing second fiddle to gold, silver came into the spotlight when the price per ounce hit $25 in late 2010 and continued to soar.

Last month, silver prices skyrocketed to an all-time high of $48 an ounce, causing many Americans to rifle through their jewelry boxes, attics and drawers for old necklaces and other silver trinkets. Silver is now trading at about $35 an ounce, but with gas and food prices soaring, people still are looking to raise some money by unloading their shiny objects. Ordinarily playing second fiddle to gold, silver came into the spotlight when the price per ounce hit $25 in late 2010 and continued to soar.

Buyers And Sellers

Toback says some of the people selling silver now are those who bought silver coins and bullion the last time the price came close to $50 an ounce back in 1980, only to watch it drop below $5 shortly thereafter. Many others, though, aren’t hobbyist investors, but ordinary people hoping to take advantage of silver’s historically high value. Many visit pawn shops or antique stores, while others sell their silver items at Tupperware-party-style events, at which guests come in with silver and leave with cash.

Volatile Metal

“Silver has been a volatile metal in terms of pricing and we’re seeing it now but I think the fundamentals still support (a) strong silver price,” Smith added. Aside from the investment perspective of silver, Smith said the industrial aspect will push silver prices higher in the long run. “There’s no more conductive metal than silver so as more computer, computer-like applications and hardware are built, it is a growing factor not only in demand, but also (in) the amount of technology that’s part of our lives,” Smith said.

Parabolic Move

What has been described as a parabolic move of silver price appears advantageous for people investing in silver with the intent to sell the metal at this time. It is becoming rather unsettling for veterans in the trade. It is clear though how the so-called market swings are going to affect the price of silver; it could either go upwards or downwards.